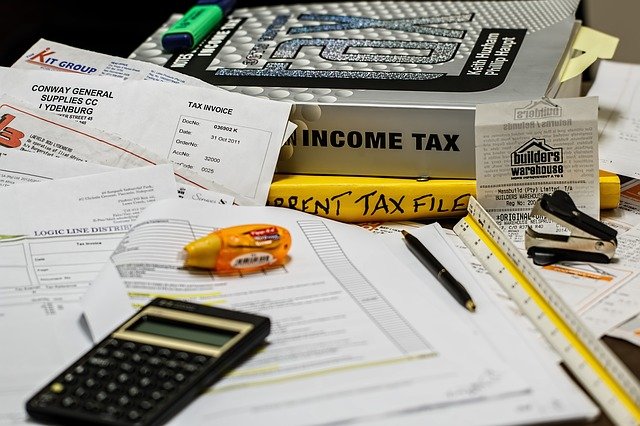

It’s that dreaded time of the year again – tax season. 1099s are arriving in the mail, CPAs are sending out their Tax Organizers, and “tax preparation” is being added to many a to-do list. The thought of getting everything together (either to file on your own or with assistance) is often filled with angst. This time of year forces us to face the litany of papers and receipts in shoe boxes, reusable shopping bags, purses and briefcases. We find ourselves carving out hours of leisure time gathering, sorting and putting some semblance of order to these papers in an effort to make our CPA’s jobs a little easier. If this is you (and it is for many as I have had 2 client requests for tax organizational help this week already, and it’s only Tuesday), then read on for tips on how to make tax preparation a little less painful. Additionally, I have included some general paper retention guidelines.

Tax Preparation Organizing Tips for THIS Tax Season:

- Gather all loose papers into the same location. Ideally you can set aside space in your home or office for this project where it won’t be disturbed.

- Create folders or envelopes for the broad categories – donations, investments, medical expenses, business meals, etc.

- If you are writing off your home office, then you will need utility and home maintenance receipts as well.

- One handful at a time, sort into your various categories.

- If possible, create a spreadsheet for each category with the date, vendor, and amount. But, if that’s more than you can bear, handing the folders over to your accountant will help immensely.

- Schedule time in your calendar to work on this project at regular intervals. No need to spend an entire weekend doing nothing else. 15 -30 minutes working one pile at a time will get it done.

Tax Preparation Organizing Tips for NEXT Tax Season:

- Consider a financial software program, such as Quicken. The time spent setting it up is well worth it! Printing a report of your various spending categories takes all of 2 minutes to then share with your CPA.

- If you prefer paper, then purchase an accordion folder with the designated tax categories and put papers in it throughout the year.

Paper Retention:

Tax and investment documents – 7 years

Real estate closing documents – Keep settlement statement, lien releases, title insurance, and survey.

Legal documents, such as wills and directives, divorce decrees, birth certificates, death certificates, adoption papers, lawsuits, etc – Keep copies handy and originals in a safe deposit box.

Utility bills – Make sure you got credited for your last payment and toss, unless you are writing off a home office and need for tax return back up.

Insurance documents – Keep the current policy only, unless you have an outstanding claim on an expired policy

Bank statements – These are rarely needed now that they can be retrieved from the bank website.

Medical records – Keep any documentation for surgeries or procedures in case you need for medical history. Routine doctor visits, dental cleaning, etc can be purged.

CAVEAT – Ask your CPA and/or attorneys for guidance and their recommendation. These are general guidelines, and your professionals know your specific situation. Therefore, it is of extreme importance that you rely on them for final say-so.

I can’t take the pain out of taxes, but if I can make the tax preparation process even a bit more streamlined and less stressful, then I will leave the accountants of the world to take it from there.

Image by Steve Buissinne from Pixabay

When shopping and acquiring becomes too much

When shopping and acquiring becomes too much